From John Burns Real Estate Consulting:

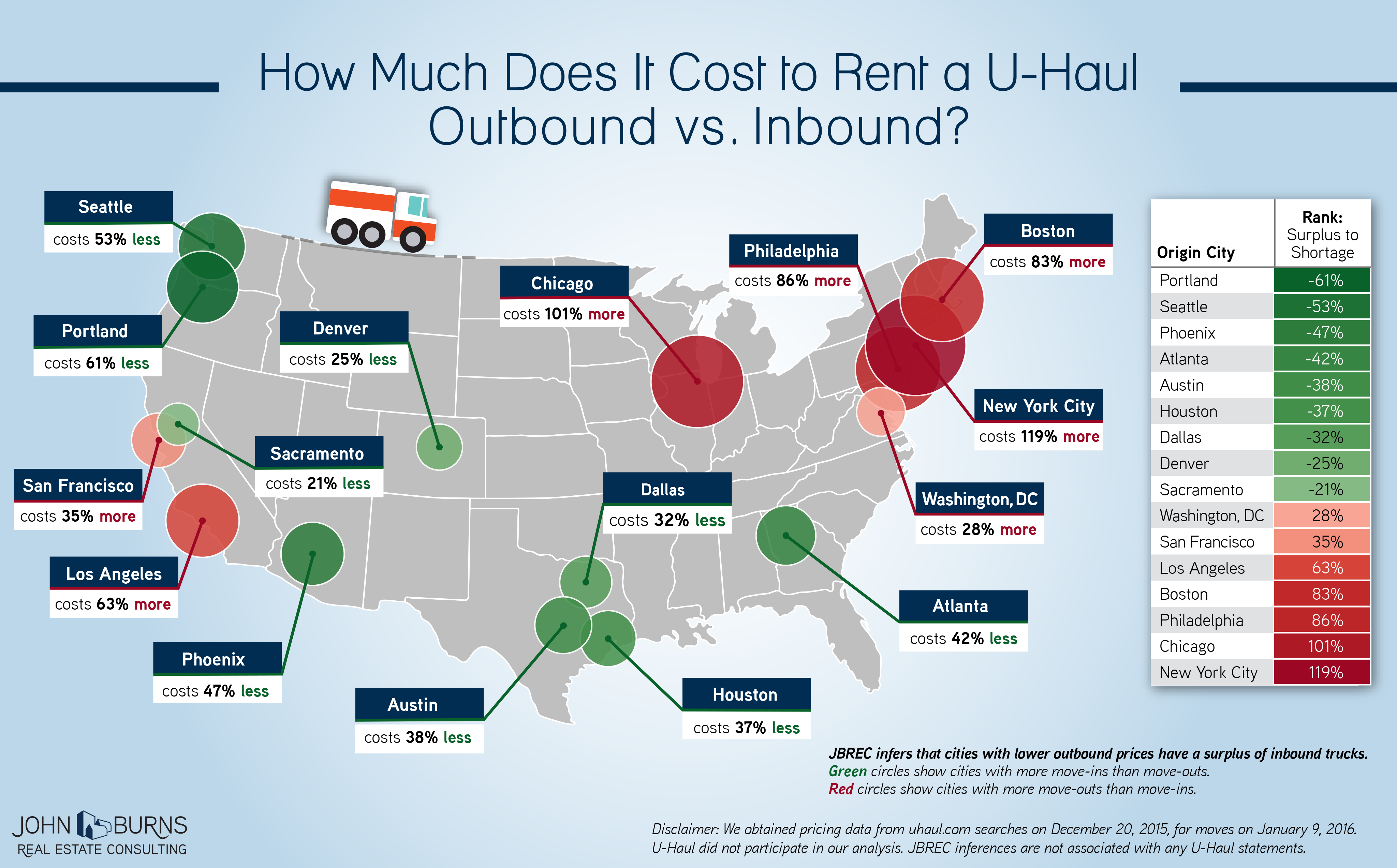

“We used average truck prices to a set of cities to rank the hottest cities for migration in real time. We discovered that pricing between single-city pairs demonstrates these trends even more clearly.

- Movers are fleeing San Francisco for less expensive tech cities. A move from San Francisco to Portland costs over seven times as much as a move in the opposite direction. A move to Seattle costs over five times more than a move back to San Francisco. U-Haul is heavily discounting trucks in the Pacific NW to get them back to San Francisco.

- But San Francisco is attracting movers from other large financial clusters. Rentals to San Francisco from NYC, Chicago, and Boston have significant cost premiums. Otherwise, it costs more to leave San Francisco.

- Movers are also leaving New York City for lower-cost large cities with higher job growth. The largest price disparities between NYC and other cities are for moves to Dallas and Atlanta. On average it costs $2,212 to rent a truck from NYC to Atlanta but only $522 from Atlanta to NYC.

In summary, despite what we hear about the urbanization of America, more Americans are heading for the newer, more affordable housing markets than the expensive, mature urban centers.”

As analytics are only as good as the data and algorithms behind them, I’d love to see how Everyhome ranks our current investment scenarios in the East Bay. They are touting the benefits of their “advice engine” pretty aggressively, here’s an excerpt from a recent article by the Puget Sound Business Journal:

Bryan Copley’s Seattle company, Everyhome, has come up with a tool that for the first time ranks every property in King County based on its redevelopment potential. Everyhome is working to roll out the tool nationwide. If successful, the six-employee company could forever change the real estate industry. Anthony Bolante

It may not be just private builders that could benefit. Everyhome could sell the service to cities struggling with gentrification. There’s “a lot of opportunity here for public good,” Copley said, if Everyhome can figure out a model where cities get the first right of refusal on properties that, if redeveloped, would displace people. Copley said making a profit is important to him, but so is that he calls “sustainable capitalism.”

The website scores each property based on its redevelopment potential. As Copley increases the website’s scoring tool, more properties drop off the map. “You start to see very tight clusters,” he said, as dots form show up on the map in the University District, Fremont, Ballard along 15th Avenue and other neighborhoods. The area with the most potential: Capitol Hill.

No word yet on what data their scoring systems use to evaluate which properties would be best suited for development (other than the “zoning” comment in the article, which it seems should be a no-brainer). If they are able to team up with a larger analytics company such as Zillow and evaluate changes in rental patterns, building permits issued, traffic flow changes et al. we might be able to see some trends that investors on the ground aren’t intuiting yet. I’m still skeptical, but willing to be convinced otherwise.

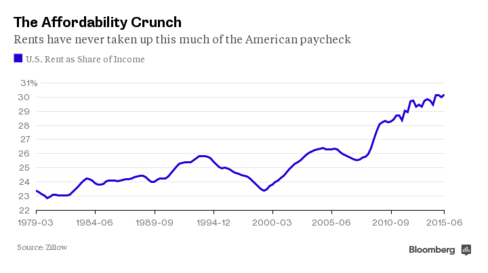

Americans living in rentals spent almost a third of their incomes on housing in the second quarter, the highest share in recent history. Rental affordability has steadily worsened, according to a new report from Zillow, which tracked data going back to 1979. A renter making the median income in the U.S. spent 30.2 percent of her income on a median-priced apartment in the second quarter, compared with 29.5 percent a year earlier. The long-term average, from 1985 to 1999, was 24.4 percent.

Source: Renting in America Has Never Been This Expensive – Bloomberg Business

From Pop Chart Lab

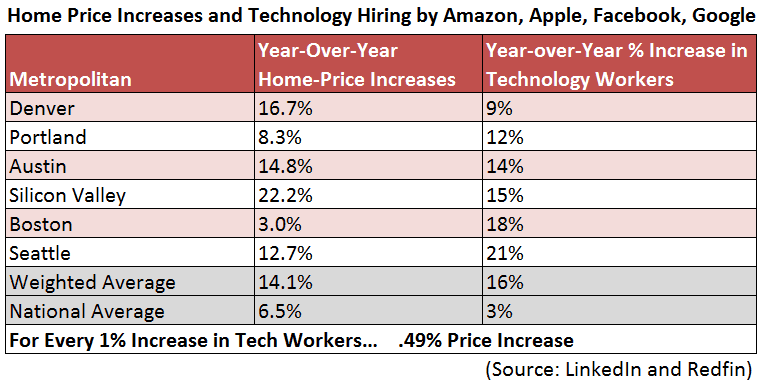

Redfin CEO Glenn Kelmann recently crunched the numbers on the rise in home prices as tech hiring picks up:

Three weeks ago, Redfin published a report showing that one in four Silicon Valley home-buyers is looking to buy a home outside of Silicon Valley, up from one in seven in 2011. This digital diaspora promises to bring some of Silicon Valley’s wealth-creation to cities across the country, especially Seattle, Portland, Austin, Boston and Denver. It has already begun to increase the cost of living.

But exactly how many technology workers does it take to increase home prices in these cities? To answer that question, Redfin took the hiring of the four largest Internet-related companies — Google, Apple, Facebook and Amazon, in Silicon Valley and beyond — as a proxy for each metropolitan area’s overall growth in technology hiring. What we found is that for every 1% increase in technology workers, there’s a roughly half-percent increase in home prices above and beyond the national rate of appreciation.